However if the activity of trading in shares is frequent enough the Malaysian Inland Revenue Board IRB may treat the gain as a. 22 The provisions of the Income Tax Act 1967 ITA related to this PR are section 2 paragraph 61h section 60G and Part I of Schedule 1 and Part IX of Schedule 1.

Last amendment included here is the Federal Constitution Amendment Act 1995 which entered.

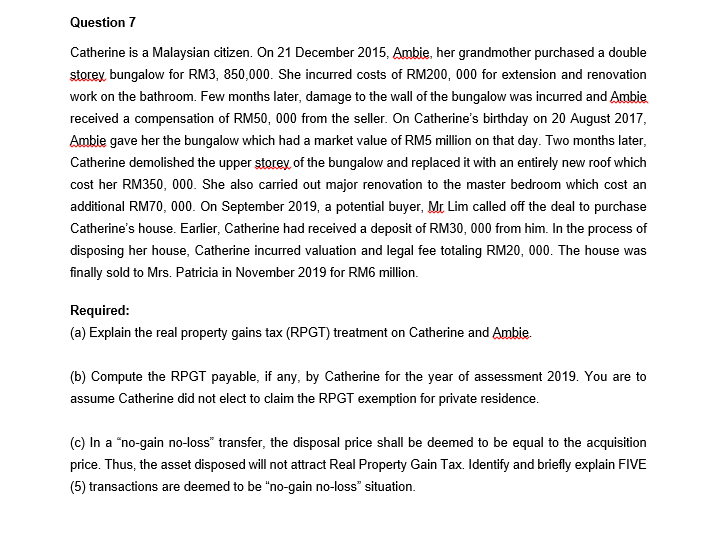

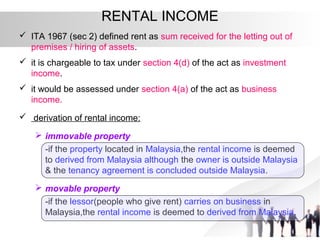

. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Subsection 252 of Real Property Gains Tax Act 1967.

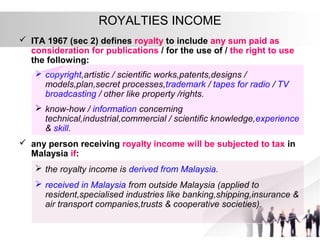

However certain royalty income earned by a non-resident person may be exempted from tax. The Malaysian Inland Revenue Boards IRB Transfer Pricing Guidelines 2012 were introduced in July 2012 replacing its 2003 guidelinesThe guidelines explain the administrative requirements of the application of Section 140A of the Income Tax Act 1967 and the Income Tax Transfer Pricing Rules 2012. A 175 has been introduced to restrict deductions for interest expenses or any other payments which are economically equivalent to interest to ensure that such expenses commensurate with the business income.

22 The provisions of the Income Tax Act 1967 ITA related to this PR are paragraphs 4a and 4c section 4B subsection 245 and 331 section 39 paragraphs 2 and 3 and Schedule 3 of the ITA. Income tax act 1967 revised 1971 laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6. 23 The relevant subsidiary legislations referred to in this PR are.

The original Constitution was first introduced as the Constitution of the Federation of Malaya on Merdeka Day 31 August 1957 and subsequently introduced as the Constitution of Malaysia on Malaysia Day 16 September 1963. Case Report Real Property Gains Tax. 32 Exchange rate means the ratio of exchange for two currencies.

Find out more. LAWS OF MALAYSIA Act 833 FINANCE ACT 2021 An Act to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Stamp Act 1949 the Petroleum Income Tax Act 1967 the Labuan Business Activity Tax Act 1990 the Promotion of Investments Act 1986 the Finance Act 2012 and the Finance Act 2018. This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019.

KSB V Ketua Pengarah Hasil Dalam Negeri. A Income Tax Exemption No. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU.

Government of Malaysia V MNMN. ENACTED by the Parliament of Malaysia as follows. This is an unofficial consolidation.

According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars. Paragraph 11 2c Schedule 2 of Real Property Gains Tax Act 1967. Non-chargeability to tax in respect of offshore business activity 3 C.

Interpretation 31 Individual means a natural person. Charge of income tax 3 A. Such employee must receive their employment income prescribed under Section 13 of the Income Tax Act 1967.

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. Such employee must serve under the same employer for a period of 12. Short title and commencement 2.

Malaysia Income Tax Act 1967 with Complete Regulations and Rules 10th Edition Find out more. 15 Order 2007 PUA 1992007. Malaysia Master Tax Guide 2021 - 38th Edition.

1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status. Starting from Malaysia income tax Year of Assessment 2014. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Veerinder on Malaysian Tax Theory And Practice 5th Edition. Relevant regulations transfer pricing Malaysia. However foreign-sourced income of all Malaysian tax residents except for the.

Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990 LBATA. MTD of such employee must be made under the Income Tax Deduction from Remuneration Rules 1994. Guide to Company Secretarial Practice in Malaysia - 5th Edition.

Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax.

Super Profits Tax Act 1963 14 of 1963 Income-Tax Amendment Act 1963 43 of 1963 Central Boards of Revenue Act 1963 54 of 1963 Taxation Laws Extension to Union Territories Regulation 1963 Finance Act 1964 5 of 1964 Direct Taxes Amendment Act 1964 31 of 1964 Income-Tax Amendment Act 1965 1 of 1965. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Case Report Stay of Proceeding.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA.

When investing in shares or stocks investors may focus on investing either for dividend yields or capital gains.

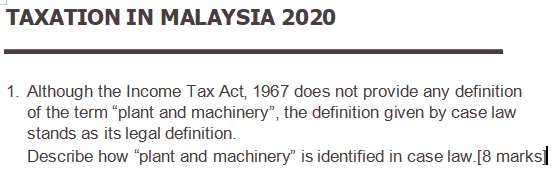

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

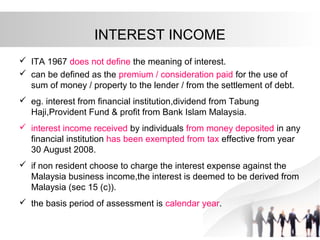

Taxation Principles Dividend Interest Rental Royalty And Other So

Individual Income Tax In Malaysia For Expats Gpa

Taxation Principles Dividend Interest Rental Royalty And Other So

Ktps Consulting Income Tax Exemption Order 2021 Facebook

Taxation Principles Dividend Interest Rental Royalty And Other So

As An Employer What Are Their Obligations In Terms Of Income Tax

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery

Taxation Principles Dividend Interest Rental Royalty And Other So

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Taxation Principles Dividend Interest Rental Royalty And Other So

Asia Briefing Individual Income Tax In Malaysia For Expatriates

Rental Income Cash Basis Or Accrual Basis

Withdrawal Of Stock Tax Risks Crowe Malaysia Plt

Taxation Of Foreign Source Income In Malaysia International Tax Review

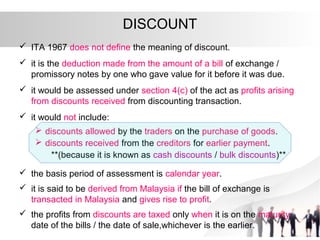

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development Happy Students